The FDA just ended access to cheaper GLP-1 alternatives – why are the brand-name drugs so expensive?

The End of GLP-1 Compounding Loophole

The Food and Drug Administration’s February 2025 declaration that Novo Nordisk’s Ozempic and Wegovy are no longer in shortage 1 has set off alarm bells for millions of Americans who relied on cheaper, compounded versions of these life-changing medications. This announcement – coming on the heels of a similar ruling in January for Eli Lilly’s tirzepatide (Mounjaro/Zepbound) 2 – effectively ends the regulatory leeway that allowed compounding pharmacies to produce lower-cost semaglutide or tirzepatide. Now, patients who had been paying a fraction of the official price must grapple with $1,000+ monthly costs or risk discontinuing therapy altogether.

Given this shock to the system, it’s worth reexamining a few simple and fundamental questions: why are brand-name GLP-1 drugs so expensive? Why are these astronomical prices a uniquely American phenomenon? And how can we break the cycle and ensure afforable, ready access for the patients who most need these medications?

Bad News for Compounded GLP-1 Sellers

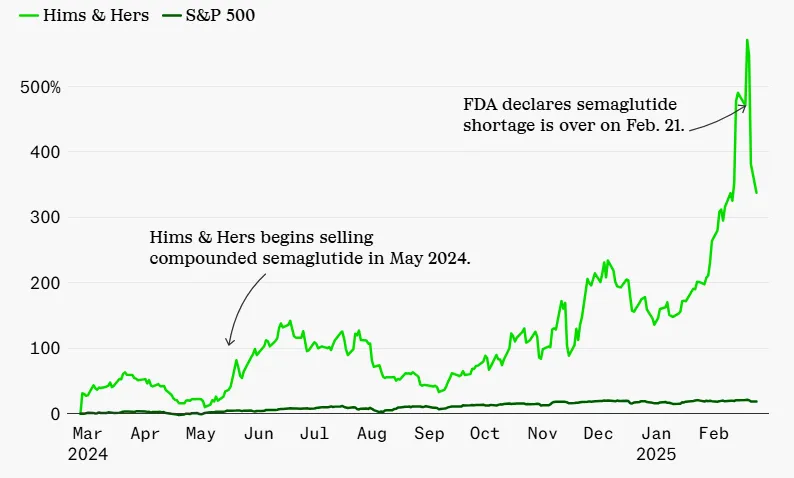

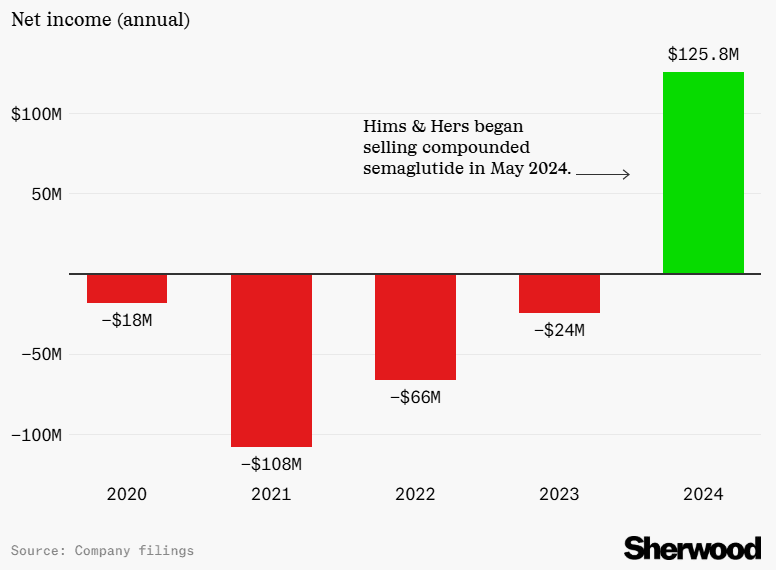

Hims & Hers, a telehealth firm that previously sold compounded semaglutide, saw its stock plummet by 26% following the FDA announcement 3. The company had reported $1.5 billion in annual revenue in 2024 – a 69% increase from the prior year 4 – fueled largely by demand for affordable GLP-1 alternatives. Although Hims & Hers initially pledged to keep offering personalized options, it later confirmed it would discontinue compounded semaglutide by the end of Q1 2025 5.

Alliance for Pharmacy Compounding CEO Scott Brunner worries about the human toll of the ruling. “All we can do now is watch what happens as patients hear the news and try to get a new prescription for the FDA-approved drug.” He notes the “sticker shock” of branded semaglutide puts it out of reach for many patients 6.

Some compounders are challenging the decision in court. The Outsourcing Facilities Association and Texas-based FarmaKeio Superior Custom Compounding filed suit in Fort Worth, alleging that the FDA is “dismissing evidence that the shortage persists” and removing the drugs from its shortage list “without notice-and-comment rulemaking.” 7

Price Shock for Patients

“Today is not a good day for those suffering from chronic disease,” said Noom CEO Geoff Cook, whose digital health company prescribes compounded semaglutide 8. The FDA’s wind-down period allows compounders until April 22 to stop selling copycat versions 9 – giving patients and providers only a brief window to make alternative arrangements. For many, that means confronting the stark reality that the brand-name drugs come with punishing price tags.

While it addresses legitimate safety concerns surrounding unregulated “knockoff” medications, the FDA’s decision exposes deeper flaws in the American healthcare system. It forces a reckoning with short-term economic incentives that render revolutionary treatments inaccessible, even when the long-term medical and financial benefits could be enormous.

Jason Krynicki, Bariatric Insurance Coordinator at Robert Wood Johnson University Hospital and National Board Member of the Obesity Action Coalition, has experienced the economic anxiety of sudden GLP-1 price increases first-hand: “I lost my personal coverage in February 2023 at RWJ – they’re no longer covering obesity medications. I had to tap into my own savings to cover my GLP-1 drugs, which has put me in a really tough spot,” he explains.

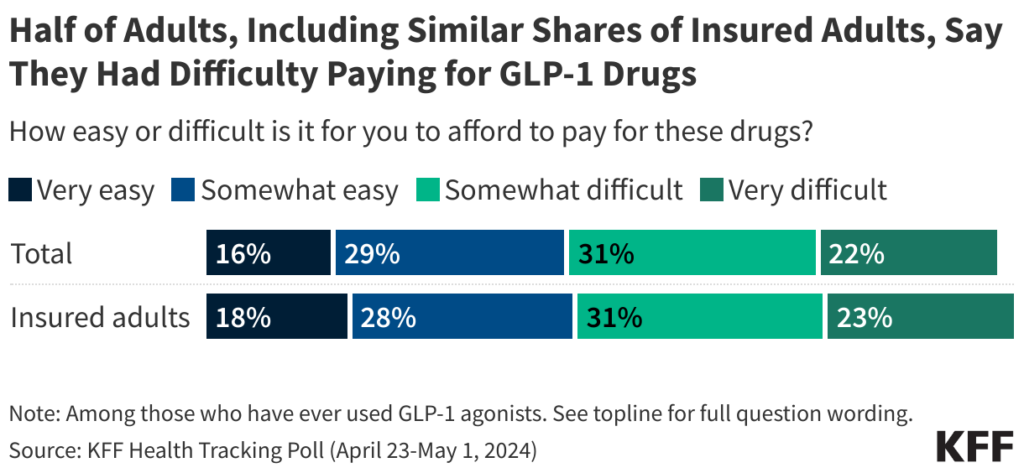

Now, with cheaper compounding options phased out, millions of patients who have been taking compounded GLP-1s in the US are about to experience the same price shock. These patients must either pay significantly higher prices for brand-name products, fight for insurance coverage that often doesn’t exist, or give up treatment altogether.

The Price-Value Disconnect: Why GLP-1 Drugs Cost So Much

Manufacturer Margins: A Legal Monopoly

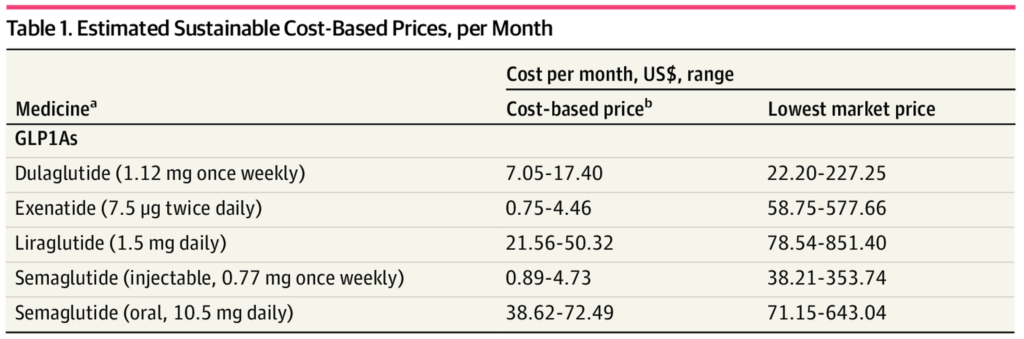

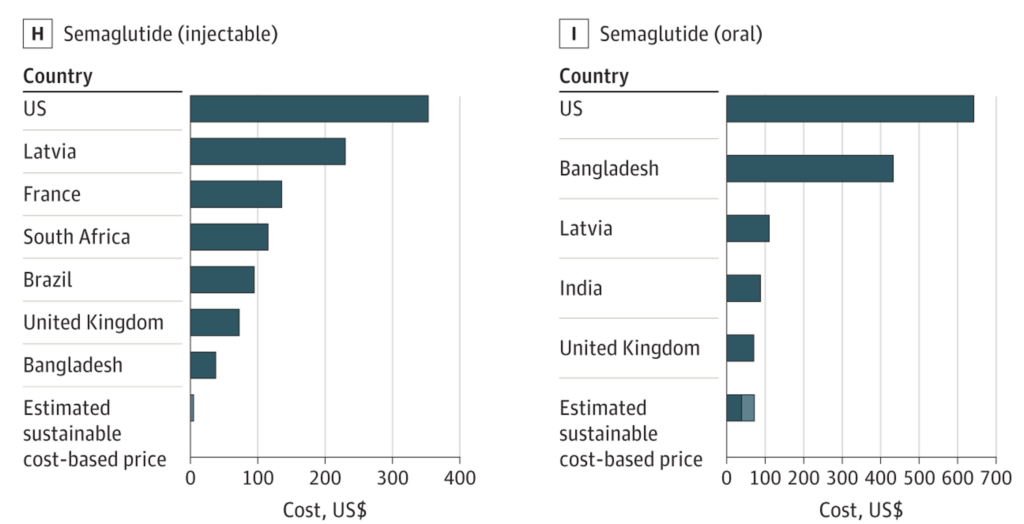

Scrapping cheaper compounded versions shines a harsh spotlight on the massive disconnect between production costs and retail prices for GLP-1 medications. In 2023, a Yale study revealed that a monthly supply of semaglutide can be manufactured for as little as $0.89 to $4.73, yet the list price in the U.S. can exceed $1,000 10. This 21,000% markup is often justified by pharmaceutical firms as necessary to cover R&D costs, clinical trials, and the “innovation premium” that patents provide until the early 2030s.

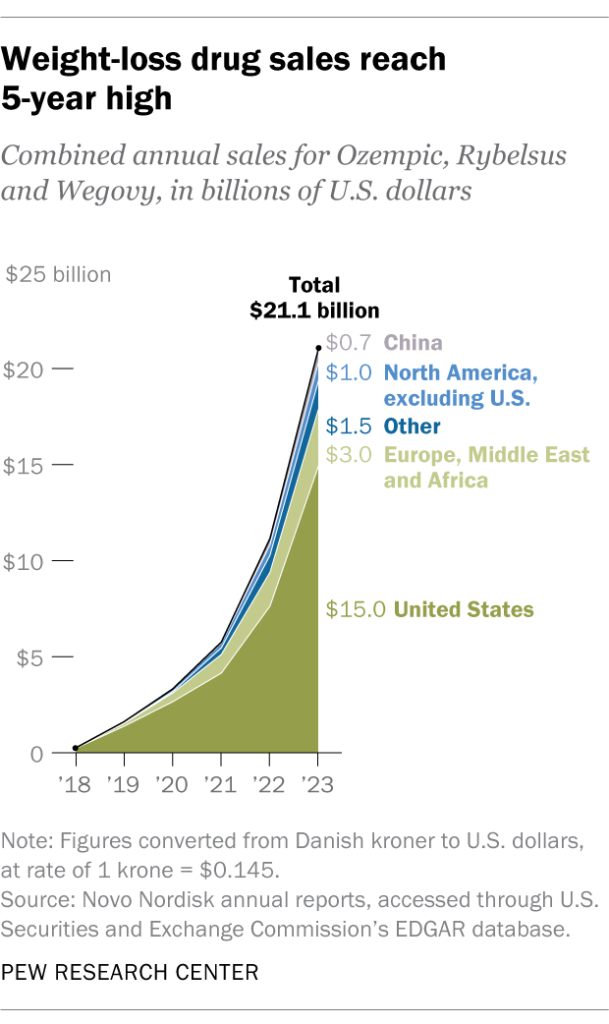

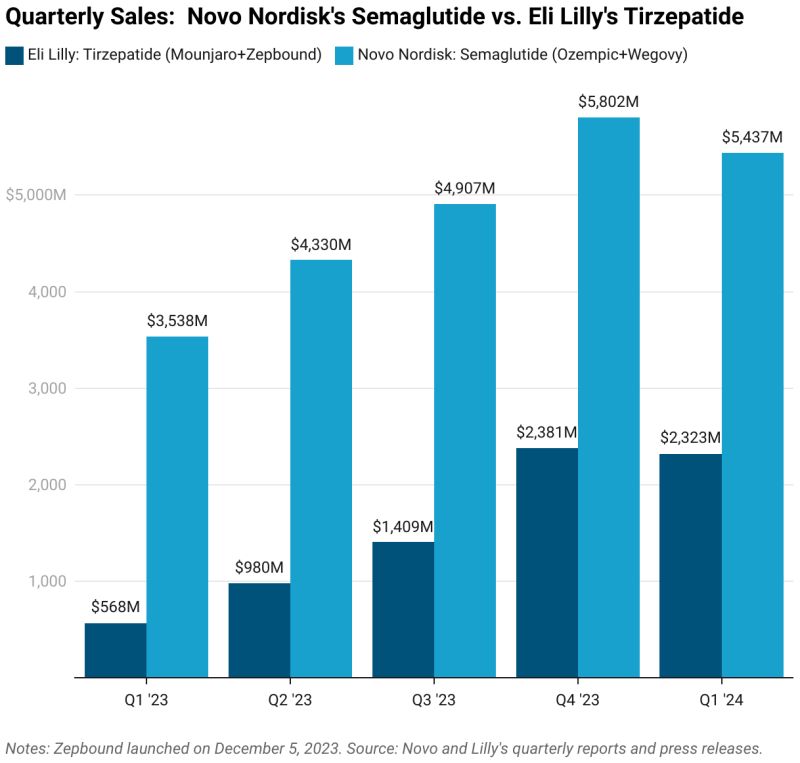

Novo Nordisk and Eli Lilly have capitalized on this exclusivity to maintain premium pricing and post record profits. Novo reported more than $21 billion in combined 2023 revenue for semaglutide (Ozempic, Rybelsus, and Wegovy) alone 11. “Manufacturers are responsible for the ultra-high prices,” argues Krynicki. “They can afford to lower them. The drugs need to be more affordable for people who need obesity care, not just celebrities.”

In a 2024 hearing, Senator Bernie Sanders challenged Novo Nordisk’s CEO on why the same medication costs $969 in the United States but only $59 in Germany – an over 16-fold difference 12. The manufacturer pointed to “significant safety risks” with copycat drugs, praised the FDA for “protecting patients,” and insisted that its $6.5 billion investment this year to expand U.S. production underscores its commitment.

Yet critics remain skeptical that higher supply alone will tame prices, given manufacturers’ inherent profit-seeking incentives. Critics fear manufacturers like Novo Nordisk and Eli Lilly will exploit their temporary monopoly to milk the the GLP-1 cash cow as hard as they can – perpetuating the affordability crisis for patients.

Insurer Incentives: Short-Term Savings

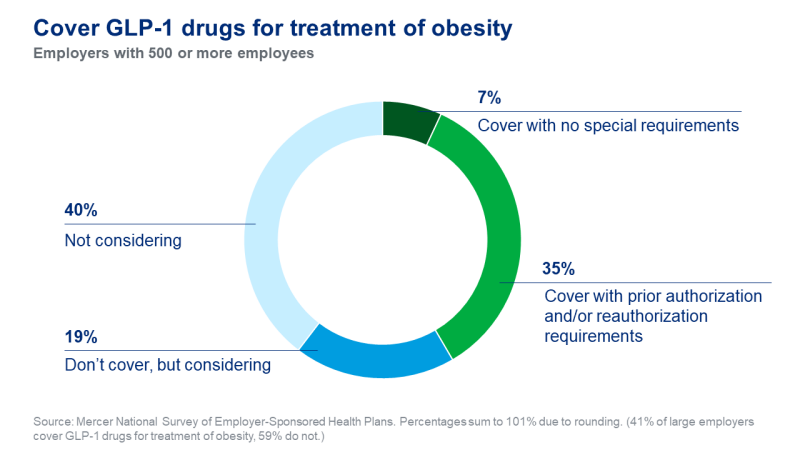

For health insurers, GLP-1 medications pose a thorny financial puzzle. A single patient’s therapy can cost $11,000 or more per year 13 – potentially blowing up budgets if even a modest fraction of eligible members adopt GLP-1 drugs. Now, with the Trump administration reevaluating the Biden administrations decision to require Medicare and Medicaid to cover anti-obesity drugs 14, the stakes could soon escalate.

Insurers are fighting hard against GLP-1 medication coverage for obesity care. AHIP, the largest U.S. health insurer trade group, warns that blanket coverage of weight-loss drugs could “subvert congressional intent” and “bust budgets” if the treatments prove extremely popular 15. Others, like Ceci Connolly of the Alliance of Community Health Plans, argue that “spending big, big bucks on something that still has so many unknowns really jeopardizes the limited dollars and resources that a plan has.” 16

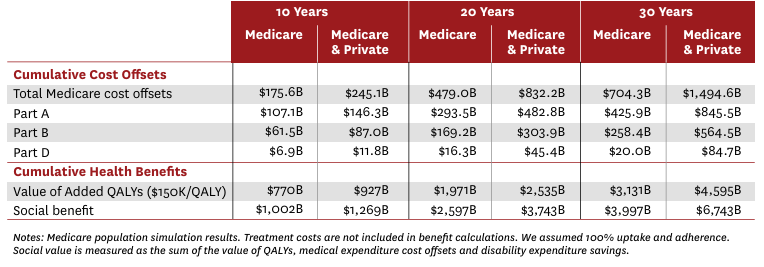

Value to Medicare from Covering and Treating Obesity (Difference from Status Quo)

Yet a 2023 paper from the University of Southern California found that covering weight-loss drugs could save Medicare more than $175 billion to $245 billion over a decade by preventing obesity-related illnesses 17. Dr. Holly Lofton, Director of the Medical Weight Management Program at NYU Langone, emphasizes, “The medications are effective if you can get them – it’s frustrating if you can’t. Insurance access to these meds is the #1 issue in obesity care.”

Part of the problem is what economists call the “turnover problem.” 18 An insurer paying $11,000 for a member’s weight loss this year may never see the payoff if that member switches plans later – a very common occurrence in a society where health insurance is tied to employment and job changes are frequent. This dynamic explains why coverage remains erratic, with companies reluctant to absorb major upfront costs without a guaranteed long-term return.

One former high-ranking insurance executive blames high prices on the underlying profit motive: “insurance companies don’t have a desire for people to be healthier – they make money off people being sick. Doctors fight insurance companies because they actually want people to be well.”

Physicians’ Frustrations: Effective Tools Behind Paywalls

With compounding alternatives disappearing, doctors face a new level of frustration. “Many know how effective GLP-1s can be,” says Dr. Michael Weintraub of NYU Langone’s Endocrinology Department. “But the insurance company is the real gatekeeper. Patients get angry at physicians when they’re denied a known effective tool, and that puts us in a difficult spot.”

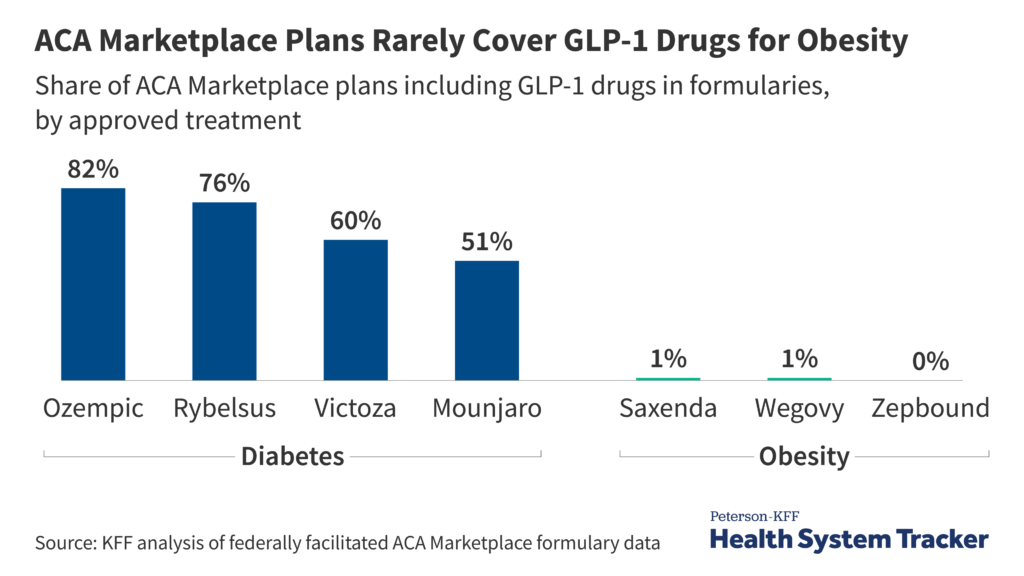

Dr. Weintraub’s practice always checks a patient’s insurance beforehand to see if coverage is offered. “More than half of insurers in our area exclude GLP-1 drugs completely,” he notes. Patients shut out of coverage often try suboptimal or risky alternatives, from dubious supplements to black-market medications.

The underlying physiology of obesity also complicates matters. Obesity is a chronic, relapsing condition requiring long-term management. Stopping medication frequently leads to rapid weight regain 19. “Obesity is a chronic condition, and its progressive nature necessitates chronic long-term treatment. If you cease intervention, then the body’s compensatory mechanisms lead to weight regain,” Weintraub explains.

Dr. Marsha Novick, a family physician practicing obesity medicine for 20 years, underscores that “lifestyle changes alone are often not enough for patients with severe obesity. GLP-1s are part of a toolbox that includes meal replacements and even bariatric surgery. Now that they’re more expensive, many patients lose that critical option.”

U.S. Pricing vs. International Models: A Stark Contrast

The FDA ruling also spotlights the vast difference between U.S. and foreign GLP-1 prices. In the U.K., Wegovy (semaglutide 2.4mg) has a list price around $160–$220 per pack, while private pharmacies charge $190–$250 monthly 20 – still far cheaper than the American $1,000-per-month price tag. Countries like France, Australia, and Japan report similarly lower costs. A Yale study found some of the lowest market prices worldwide in places such as China, France, the Philippines, and South Africa 21. Unsurprisingly, the U.S. tops the list of highest GLP-1 prices.

Experts attribute America’s outlier GLP-1 prices to:

- Lack of Government Negotiation and Price Controls – Most other wealthy nations have centralized negotiating bodies, forcing manufacturers to accept lower rates or face being excluded from coverage. With rate exceptions, the U.S. government doesn’t negotiate drug prices.

- Market Size and Ability to Pay – The U.S. is a high-income market accustomed to elevated drug costs. Companies view American patients as profitable enough to bear steep prices.

- Regulatory and Patent Landscape – Other countries may get generic or biosimilar competition earlier, whereas the U.S. remains under patent lock until the early 2030s.

Senator Sanders has lambasted manufacturers for “ripping off Americans with high drug prices,” 22 pointing out that Novo Nordisk reportedly derives 72% of its global GLP-1 revenue from the United States alone 23. Novo Nordisk’s revenue concentration is a staggering imbalance and evidence that Americans are effectively subsidizing global R&D costs by paying inflated prices.

The Economics of GLP-1 Medications: A Fundamental Analysis

The abrupt end to compounded alternatives highlights classic economic principles that shape GLP-1 drug pricing in America:

Monopoly Pricing Under Patent Protection

Patents confer a legal monopoly for 20 years (plus extensions). Without competition, manufacturers can charge far above marginal production cost. Semaglutide, for instance, costs under $5 to produce but sells for $1,000-per-month due to Novo Nordisk’s exclusive commercial rights 24.

Inelastic Demand and Value-Based Pricing

Effective obesity treatments are scarce, making demand relatively inelastic – patients and providers are willing to pay high prices when no close substitutes exist. Companies thus set prices based on the perceived value of weight loss and its health benefits, rather than production costs.

Information Asymmetry and Principal-Agent Problems

Patients often lack full knowledge or direct purchasing power, while physicians, insurers, and pharmaceutical companies each have different incentives. This mismatch leads to inefficiencies in how these drugs are prescribed and reimbursed.

The Third-Party Payer Problem

Instead of direct consumer-vendor transactions, insurance plans decide coverage. With each insurer negotiating separately, pharmaceutical firms face less unified resistance to high prices. Patients, for their part, rarely see the full price – until coverage is denied.

International Price Discrimination

Profit-maximizing firms charge each market according to willingness to pay. Because the U.S. tolerates higher prices, manufacturers capture large profit margins here while accepting lower margins abroad.

Short-Term vs. Long-Term Incentives

Insurers are incentivized to maximize immediate profits rather than investing in longer-term outcomes – they might not reap the benefits if a patient changes plans years later. This undercuts coverage for preventive treatments like GLP-1s, despite potential future savings.

Taken together, these factors create a market failure where monopoly power and fragmented insurance lead to high prices and restricted access – even though society might benefit substantially from widespread, sustainable adoption of these drugs. Ending the compounding workaround removes a modest but meaningful counterweight to the monopoly dynamic, further exacerbating the need for direct policy intervention.

Policy Solutions for a Post-Compounding Era

With the loss of compounded options, policymakers, insurers, and drugmakers face renewed pressure to improve access to GLP-1 medications. Several strategies have increased in urgency:

1. Government Price Negotiation

New provisions from the Inflation Reduction Act give Medicare limited authority to negotiate prices on certain high-cost drugs 25. Over time, GLP-1s could be added to the negotiation list once they meet the statutory requirements. If Medicare – the largest single payer – achieves lower rates, commercial insurers might follow suit or be forced to keep up.

Some officials in the Trump administration have signaled interest in allowing or requiring Medicare and Medicaid to cover anti-obesity drugs 26. If approved, it could create a powerful impetus for price concessions. However, insurers caution that covering such treatments broadly could trigger large immediate expenditures, even if it saves money downstream 27.

2. Insurance Coverage Mandates

The Treat and Reduce Obesity Act (TROA) in Congress aims to let Medicare Part D plans cover weight-loss drugs 28 – a key step toward treating obesity like other chronic diseases. Federal Employee Health Benefits plans have already moved to require coverage of obesity meds, setting a precedent. Mandating coverage in commercial markets, too, could spread costs across the entire pool and make therapy more affordable.

3. Patent and Market Exclusivity Reforms

Reforming patent “evergreening” or expediting biosimilar approvals could bring GLP-1 competition sooner, driving down costs. Evergreening extends monopoly protections through minor tweaks, while “patent thickets” delay generic entry even after core patents expire.

Policy fixes – limiting frivolous patent extensions or fast-tracking biosimilars – face legal and political hurdles but could shorten exclusivity and slash prices 29. Critics note many top-selling drugs remain under overlapping patents far beyond their original terms. Whether these reforms strike the right balance between encouraging innovation and preventing monopolistic abuse remains a key question.

4. March-In Rights

In the most extreme case, march-in rights, authorized under the Bayh-Dole Act, could be used. March-in rights allow the government to license a patent to another manufacturer in extraordinary cases – for instance, if the original patent holder fails to make the invention available on reasonable terms 30. Though rarely used, some advocates argue it could be invoked for GLP-1 drugs if sky-high prices effectively block patient access. Drugmakers counter that such a step would undermine the incentive structure for innovation and likely invite legal battles 31.

5. Alternative Funding and Pricing Models

Outcomes-based contracts – paying only if the drug achieves health improvements – could encourage coverage by reducing the perceived risk 32. States have tested “Netflix” subscription models for hepatitis C treatments, paying a flat rate for unlimited patient access 33. A variant of that approach could theoretically apply to GLP-1s, smoothing out the high per-patient costs.

One intriguing idea is a tiered treatment approach: fully cover expensive GLP-1 therapy for, say, a six-to-twelve-month period to achieve major weight loss, then transition to a cheaper maintenance protocol. This two-phase model addresses insurer anxiety about indefinite high costs while still giving patients a viable path.

A Watershed Moment for Healthcare Access

By declaring that semaglutide and tirzepatide are officially off the shortage list, the FDA has inadvertently exposed the underlying fault lines in American healthcare. Patients who relied on affordable compounded GLP-1s must now confront the branded drug’s steep price tags or risk abandoning a therapy proven to curb obesity and related illnesses.

“GLP-1s work, but the access to care needs to be there,” says Jason Krynicki, summarizing the crux of the crisis. Dr. Holly Lofton echoes this sentiment: “These drugs create hope that weight loss is possible – not as a fad diet, but with better results than old interventions. It’s frustrating that cost so often stands in the way.”

Ultimately, true reform requires more than just improved supply. It demands policy changes – whether through government price negotiation, expanded insurance coverage, or patent reforms – that align the long-term economic gains of preventing chronic disease with the short-term realities of medical decision-making and reimbursement.

As obesity continues to rise, GLP-1 medications represent both a remarkable scientific success and a sobering market failure. The end of compounded alternatives should galvanize stakeholders – from Congress to pharma CEOs – to devise strategies ensuring that life-changing therapies do not remain out of reach for the patients who need them most. Until then, the nation’s GLP-1 affordability crisis remains unresolved, underscoring the urgent need to reconcile innovation with equitable access in American healthcare.

- https://www.fda.gov/media/185526/download?attachment ↩︎

- https://www.fda.gov/drugs/drug-safety-and-availability/fda-clarifies-policies-compounders-national-glp-1-supply-begins-stabilize ↩︎

- https://www.nasdaq.com/articles/hims-hers-stock-crashed-26-today-heres-what-you-need-know ↩︎

- https://investors.hims.com/news/news-details/2025/Hims–Hers-Health-Inc.-Reports-Fourth-Quarter-and-Full-Year-2024-Financial-Results ↩︎

- https://www.businessinsider.com/hims-and-hers-stock-price-q4-earnings-obesity-drug-ozempic-2025-2 ↩︎

- https://www.pharmacypracticenews.com/Online-First/Article/02-25/FDA-Declares-End-to-Semaglutide-Shortage-Clock-Ticking-on-Compounded-Versions/76337 ↩︎

- https://www.fiercepharma.com/pharma/compounders-sue-fda-again-over-declaring-end-shortage-novos-semaglutide ↩︎

- https://www.axios.com/2025/02/24/glp1-copycat-crackdown-fda-lifts-shortage-status ↩︎

- https://www.fda.gov/drugs/drug-safety-and-availability/fda-clarifies-policies-compounders-national-glp-1-supply-begins-stabilize ↩︎

- https://www.bloomberg.com/news/articles/2024-03-27/ozempic-novo-s-1-000-diabetes-drug-can-be-made-for-less-than-5-a-month ↩︎

- https://www.pewresearch.org/short-reads/2024/03/21/as-obesity-rates-rise-in-the-us-and-worldwide-new-weight-loss-drugs-surge-in-popularity/ ↩︎

- https://www.biospace.com/policy/novo-ceo-sanders-to-face-off-over-us-prices-for-ozempic-and-wegovy ↩︎

- https://www.healthsystemtracker.org/brief/prices-of-drugs-for-weight-loss-in-the-us-and-peer-nations ↩︎

- https://www.axios.com/2025/02/20/trump-medicare-weight-loss-drugs-biden-proposal ↩︎

- https://colohealthplans.org/insurers-push-back-on-medicare-and-medicaid-coverage-for-glp-1s/ ↩︎

- https://www.axios.com/2025/02/20/trump-medicare-weight-loss-drugs-biden-proposal ↩︎

- https://healthpolicy.usc.edu/wp-content/uploads/2023/04/2023.04_Schaeffer_White_Paper_Benefits_of_Medicare_Coverage_for_Weight_Loss_Drugs.pdf ↩︎

- https://www.biopharmadive.com/news/glp1-employer-coverage-weight-loss/696545/ ↩︎

- https://www.vcuhealth.org/news/weight-loss-drugs-101-benefits-and-risks-you-need-to-know-before-picking-up-a-prescription ↩︎

- https://www.oxfordonlinepharmacy.co.uk/weight-loss/wegovy ↩︎

- https://medicine.yale.edu/news-article/prices-of-expensive-diabetes-medicines-and-weight-loss-drugs-are-drastically-higher-than-production-costs ↩︎

- https://www.sanders.senate.gov/op-eds/novo-nordisk-eli-lilly-must-stop-ripping-off-americans-with-high-drug-prices/ ↩︎

- https://x.com/BernieSanders/status/1839073044494418163?lang=en ↩︎

- https://www.bloomberg.com/news/articles/2024-03-27/ozempic-novo-s-1-000-diabetes-drug-can-be-made-for-less-than-5-a-month ↩︎

- https://www.kff.org/medicare/issue-brief/faqs-about-the-inflation-reduction-acts-medicare-drug-price-negotiation-program/ ↩︎

- https://www.kiplinger.com/retirement/medicare/medicare-2025-drug-negotiation-list-includes-ozempic-and-wegovy ↩︎

- https://www.axios.com/2025/02/20/trump-medicare-weight-loss-drugs-biden-proposal ↩︎

- https://www.obesityaction.org/troa/troa-faq/ ↩︎

- https://pubmed.ncbi.nlm.nih.gov/37505513/ ↩︎

- https://www.nber.org/papers/w32217 ↩︎

- https://www.nber.org/papers/w32217 ↩︎

- https://www.lyfegen.com/post/linking-drug-prices-to-success-the-power-of-outcome-based-agreements-in-the-ozempic-era ↩︎

- https://healthpolicy.usc.edu/article/using-the-drug-pricing-netflix-model-to-help-states-tackle-the-hep-c-crisis ↩︎

Leave a Reply