Protein demand is hotter than ever, but not all proteins are created equal. Why more strategic protein innovators will be the ultimate winners in the GLP-1 nutrition space.

The Protein Gold Rush

The protein gold rush has CPG brands adding whey to everything from candy bars to pasta sauce. Convincing healthy people they need 40 grams of protein in their morning coffee can hardly be considered innovation – it’s just clever marketing. Companies are creating solutions for problems that don’t exist while ignoring a real, substantially more promising and profitable opportunity.

This explosion of high-protein everything is driven by influencer marketing and social media trends. Brand companies – essentially marketing entities that own no factories or equipment – ride these trends by contracting out production. When the trend fades, they’ll simply launch new brands to chase the next fad.

Meanwhile, ingredient suppliers invested heavily in protein production capacity to meet this hype-driven demand are now in desperate search of new applications. Most recently, the plant-based boom left these companies with specialized facilities, advanced protein processing capabilities, and long-term supply contracts, but plateauing demand.

The companies that are actually responsible for making real things in the real world – i.e., ingredient suppliers and co-manufacturers – have learned to serve whatever trend brand companies are chasing this quarter. They invest just enough capacity for today’s fad, knowing tomorrow will bring something different. This dynamic constrains genuine innovation. Why develop precise purification systems that maintain functionality when your customers’ marketing departments only care about riding the current hype train?

Current and former GLP-1 users are real people whose quality of life is directly tied to the food they consume. They need nutritionally dense food, not products plastered with meaningless claims. For companies tired of chasing fads, this represents something rare: medical need driving sustained demand. This is the market that justifies real innovation – where functionality and clinical outcomes matter more than marketing claims, where customers will pay premiums for products that actually work.

GLP-1s: A Tale of Two Markets

The rise of GLP-1 medications has created two distinct populations with urgent nutritional needs that standard protein products ignore.

Current Users: The Immediate Challenge

- Muscle loss: Up to one-third of weight loss comes from lean tissue, not fat 1

- Severe portion limits: Can only manage 4-6 oz of food per meal

- GI sensitivity: Cannot tolerate traditional high-fiber foods or standard protein sources

- Nutrient density imperative: With drastically reduced intake, every bite must deliver maximum nutrition

Former Users: The Growing Opportunity

- 85% discontinue within two years due to cost and insurance barriers 2

- Metabolic damage: Lower muscle mass, reduced metabolic rate

- Weight regain: Two-thirds of lost weight typically returns, mostly as fat 3

- Premium price conditioning: Previously paid $1,200-1,500/month for medication 4

Both groups share critical characteristics:

- Medical necessity for high-quality protein

- Sophisticated understanding of nutrition from treatment experience

- Proven willingness to pay premium prices for solutions that work

- Altered physiology requiring specialized formulations

Why Current High-Protein Products Fall Short

The protein-fortified food industry has mastered marketing but ignores quality. Most products deliver poor-quality protein that the body can barely use.

Here’s what matters: PDCAAS (Protein Digestibility Corrected Amino Acid Score) measures true protein quality. A score of 1.0 means optimal quality. Most trendy protein products don’t come close because high-quality protein is expensive, and the average consumer buying a protein cookie isn’t checking amino acid profiles.

This works when your customers are healthy people who don’t need extra protein. Most Americans already consume excessive protein. But GLP-1 users face genuine muscle loss risks and need products designed for medical nutrition, not Instagram appeal.

Key failures of current products:

- Poor protein quality: PDCAAS scores of 0.1-0.2 when optimal is 1.0

- Wrong format: 12-oz shakes when users can only manage 4-6 oz

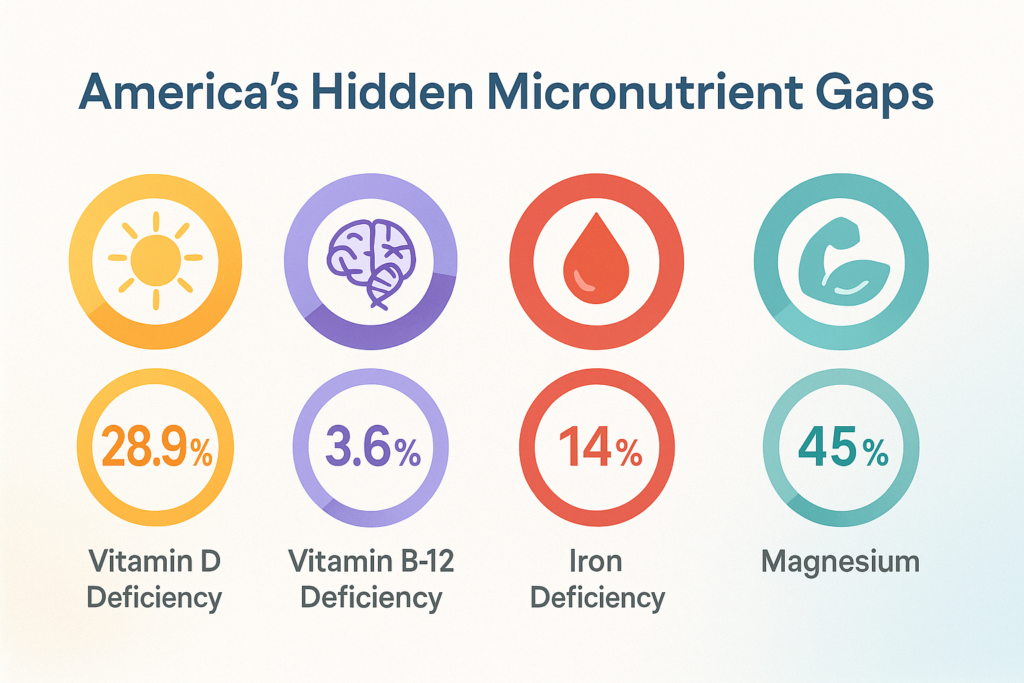

- Inadequate nutrient density: Missing critical micronutrientsVitamin D: 28.9 % deficient (<50 nmol/L) 5

- Ignores GI sensitivity: Denatured proteins slow digestion and reduce bioavailability; when fiber is present, it’s typically bulk-forming types that worsen symptoms by binding water, creating gas, thus slowing down already-slowed digestive systems

If an ingredient supplier develops proteins with optimized amino acid profiles and enhanced digestibility, they certainly won’t be advertising PDCAAS scores on TikTok. The non-medical market rewards trendy labels over technical specifications.

The High-Protein Market Opportunity

By The Numbers

By early 2024, roughly one in eight American adults had used a GLP-1 medication 9 – unprecedented adoption for a prescription obesity treatment. With 30 million Americans having tried GLP-1s 10 and an 85% discontinuation rate, we face a projected population of 25 million post-GLP-1 users within the next few years.

These aren’t casual dieters. They’ve experienced pharmaceutical-grade results and understand the stakes. Most importantly, their experience paying $1,200-1,500 monthly for medication creates powerful price anchoring. A specialized functional food program costing $150-200 monthly ought to be affordable by comparison.

Intersecting Opportunities

Regulatory catalyst: The FDA’s recent declaration ending GLP-1 shortages 11 access to affordable compounded versions. Millions must now choose between paying full price or discontinuing treatment.

Supply meets demand: Ingredient suppliers with excess capacity from the plant-based boom 12, 13 possess the technical capabilities to create clinical-grade ingredients – they just need a market that values quality over marketing.

No dominant player:

- Sports nutrition brands focus on athletes seeking muscle gains (supplements for enhancement, not medical needs)

- Weight loss companies push meal replacements and appetite suppressants (often high fiber formulas that worsen GI distress)

- Medical nutrition serves hospital patients with specific clinical protocols (requires prescription, too narrow for broad GLP-1 population)

None of these directly address the unique needs of current or former GLP-1 users – yet all the necessary components exist across these markets. This gap creates an opportunity for companies willing to combine clinical-grade quality with consumer-friendly formats.

Why Most Companies Will Miss This

Brand companies chasing protein trends are structurally unsuited for medical nutrition:

- R&D priorities: Focus on taste and broad market appeal, not therapeutic efficacy

- Distribution models: Built for high-velocity mass market, not premium, specialized products

- Marketing metrics: Reward shelf turns and market share, not health outcomes

- The short-term trap: Chasing quick profits through trendy products guarantees commodity pricing and thin margins. High-margin opportunities require long-term investment in clinical validation and precise manufacturing – commitments that quarterly-focused companies won’t make

The companies that recognize this gap – and have the technical capability to bridge it – will define the next decade of functional food.

The Path to Prosperity

Success in this market requires rethinking fundamental assumptions about product design:

Format is everything: Products must work within 4-6 oz portion limits while delivering the 25-30g of quality protein needed per meal to stimulate muscle protein synthesis 14. Plus, they need to include essential micronutrients.

Quality over marketing: Pre-digested proteins, gentle fibers, bioavailable micronutrients – the ingredients that matter won’t fit on a trendy label.

Distribution strategy: Direct-to-consumer or specialty channels that allow for education and premium pricing.

Companies positioned to win aren’t necessarily those with medical food experience – they’re those willing to treat this as the medical nutrition challenge it is. A nimble contract manufacturer could partner with the right brand. An innovative ingredient supplier could develop turnkey solutions.

Seize the Moment

The market is developing rapidly. Regulatory changes and discontinuation patterns are creating new cohorts of former users each month.

The convergence of opportunities makes the current moment a unique – and fleeting – one:

- 25 million consumers with proven premium spending capacity

- Ingredient suppliers with excess capacity and technical capabilities

- No established market leader

- Innovation comes from combining three successful models (D2C distribution, medical nutrition, premium pricing) to create a new product category

For ingredient suppliers and contract manufacturers tired of chasing quarterly fads, this represents something rare: a chance to build lasting value by solving real problems.

The question isn’t whether this market will develop – it’s who will capture it first.

Interested in exploring how your capabilities could serve this emerging market?

Contact David Goulder to discuss the technical and market requirements necessary to seize this moment.

Lance Lively is the Founder of The Gut Punch, a platform investigating the intersection of food and health. He’s served as a senior leader at a number of venture-backed biotechnology companies. A Princeton and Wharton graduate, he focuses on human health, novel modalities to improve wellness, and the science of addiction.

David Goulder is the founder of Food Science and Applied Research Consulting, with 11 years of experience in food science and technology. He works at the intersection of science, strategy, and product development – helping teams solve complex technical challenges efficiently, from ingredient functionality and formulation to integrating new research and scaling innovation. David holds a BS and MS in Food Science and Technology.

To explore consulting opportunities, contact David via his email, visit his website, or book a meeting.

- https://www.thelancet.com/journals/landia/article/PIIS2213-8587%2824%2900272-9/abstract ↩︎

- https://www.reuters.com/business/healthcare-pharmaceuticals/most-patients-stop-using-wegovy-ozempic-weight-loss-within-two-years-analysis-2024-07-10/ ↩︎

- https://www.reuters.com/business/healthcare-pharmaceuticals/novo-nordisk-rivals-see-room-compete-100-bln-weight-loss-drug-market-2023-05-04 ↩︎

- https://www.goodrx.com/wegovy/wegovy-for-weight-loss-cost-coverage ↩︎

- https://pmc.ncbi.nlm.nih.gov/articles/PMC9573946 ↩︎

- https://ods.od.nih.gov/factsheets/VitaminB12-HealthProfessional ↩︎

- https://pmc.ncbi.nlm.nih.gov/articles/PMC11423176 ↩︎

- https://pmc.ncbi.nlm.nih.gov/articles/PMC6163803 ↩︎

- https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/ ↩︎

- https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs/ ↩︎

- https://www.fda.gov/drugs/drug-safety-and-availability/fda-clarifies-policies-compounders-national-glp-1-supply-begins-stabilize ↩︎

- https://www.fooddive.com/news/plant-based-trends-2024-beef-up-messaging/705207/ ↩︎

- https://www.reuters.com/business/beyond-meat-withdraws-annual-forecasts-targets-q2-sales-below-estimates-2025-05-07 ↩︎

- https://pmc.ncbi.nlm.nih.gov/articles/PMC2760315 ↩︎

Leave a Reply