Insights from food & health industry leaders at the MISTA Healthy Nutrition Symposium

The GLP-1 Disruption Through the Eyes of Experts

The food industry is facing an unprecedented challenge: a new class of drugs is dramatically changing how people eat. GLP-1 agonist medications – like Ozempic, Wegovy, and Mounjaro – have emerged as powerful appetite suppressants by mimicking a gut hormone that regulates hunger. Originally developed to treat diabetes, they are now reshaping what consumers buy, how they snack, and how companies innovate.

It’s one thing for a new diet craze to ask consumers to choose differently; it’s another for a prescription drug to make them feel differently. As appetite literally shuts down and satiety spikes, major food and beverage categories feel the impact.

Analysts warn billions of dollars of consumer spending are up for grabs. KPMG projects consumers may spend $48 billion less on food and drink each year for the next decade due to GLP-1 use 1. Some of the world’s biggest players – Nestlé, Coca-Cola, Danone, Conagra – are already pivoting to meet the GLP-1 moment.

“We don’t want to be the last guy,” admits Conagra Senior VP Bob Nolan.

So how should the food industry respond? To explore this question, I convened a panel of four experts at MISTA’s 2025 Healthy Nutrition Symposium:

- Cate Ward (Semper Organics): Scientist, dietitian, and Stanford University researcher whose work intersects nutrition and microbiome science.

- Jenny Zegler (Mintel): Director of global food and drink research at Mintel with 17 years covering food and beverage innovation.

- Emilie Fromentin (Givaudan): Head of Explore Health, Functional, and Color at Givaudan, a global leader in flavors, ingredients, and nutritional solutions.

- Rocio Martin (Danone): Senior Director of Life Science Innovation at Danone, focused on biotics, proteins, and overall health benefits in food.

Our conversation reveals how GLP-1 medications are reshaping consumer behaviors at a biological level – and how food companies can position themselves to not only survive but thrive in this new world.

The Physiological and Behavioral Impact of GLP-1s on Food Consumption

Changing the Fundamentals of Consumption

The physiological punch of GLP-1 agonists is impossible to ignore. By slowing gastric emptying and blunting hunger signals, these drugs lead people to feel full on far less food.

“These medications reduce the craveability of food and increase satiety,” says Cate Ward. “But they also come with side effects like GI symptoms and nausea.”

Data from Mintel underscores how this plays out in daily eating habits. According to Jenny Zegler:

“Smaller portions are the new norm for GLP-1 users. Yet our research finds 51% of U.S. adults on these drugs increased their snacking compared to the previous year, far surpassing the 25% figure for all U.S. adults.”

This contradiction – snacking more, yet eating smaller total quantities – suggests consumers are reorganizing how and when they eat, rather than blindly restricting all food. Danone’s internal data points to another shift:

“GLP-1 users are consuming smaller meals but more frequently, and more healthy snacks – fruits, vegetables, dairy, high-protein, and fiber-rich foods – while decreasing processed items, sweets, and alcohol,” explains Rocio Martin.

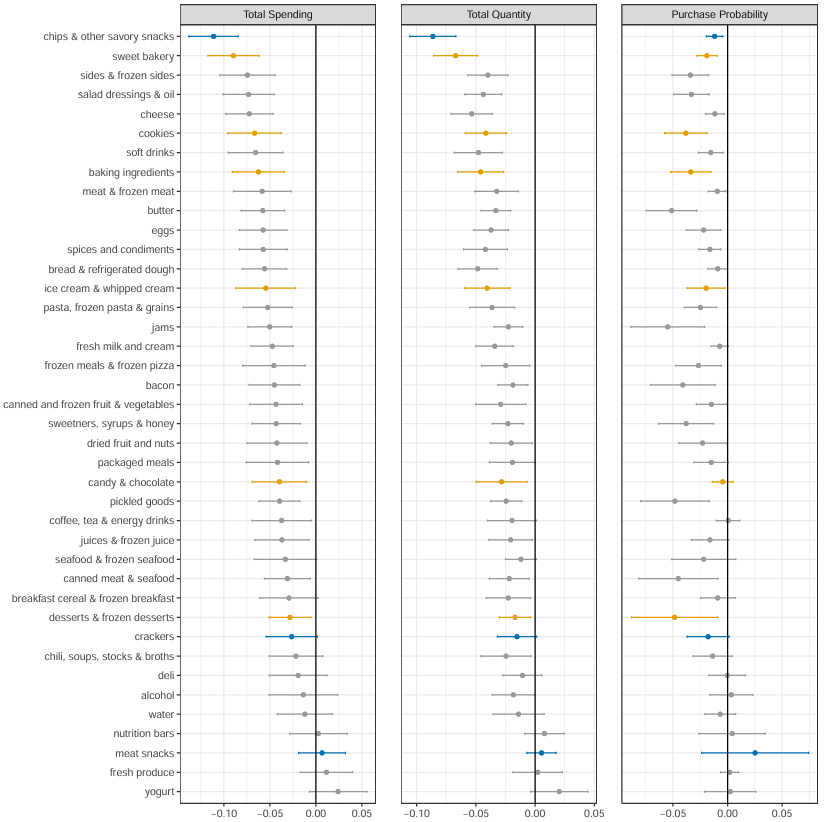

In fact, many GLP-1 households are increasing their spend on yogurt, ready-to-drink protein shakes, and nutrition bars at higher rates than non-users. A recent Cornell study bears this out: in the first six months, savory snack buys dropped 11% and sweet baked goods 9%, while spending on healthy staples climbed 2.

The No-Hunger Games: How GLP-1 Medication Adoption is Changing Consumer Food Demand

Evolution of Eating Patterns Across the GLP-1 Journey

Food preferences also shift throughout a GLP-1 user’s journey. Early adopters often battle nausea and intense fullness, then pivot to optimizing diet quality once maintenance sets in.

“They start caring about not losing too much muscle and ensuring adequate nutrients in a limited diet,” says Ward, who sees many GLP-1 patients in her private practice. “After stopping the medication, some are determined to keep the weight off by improving diet quality.”

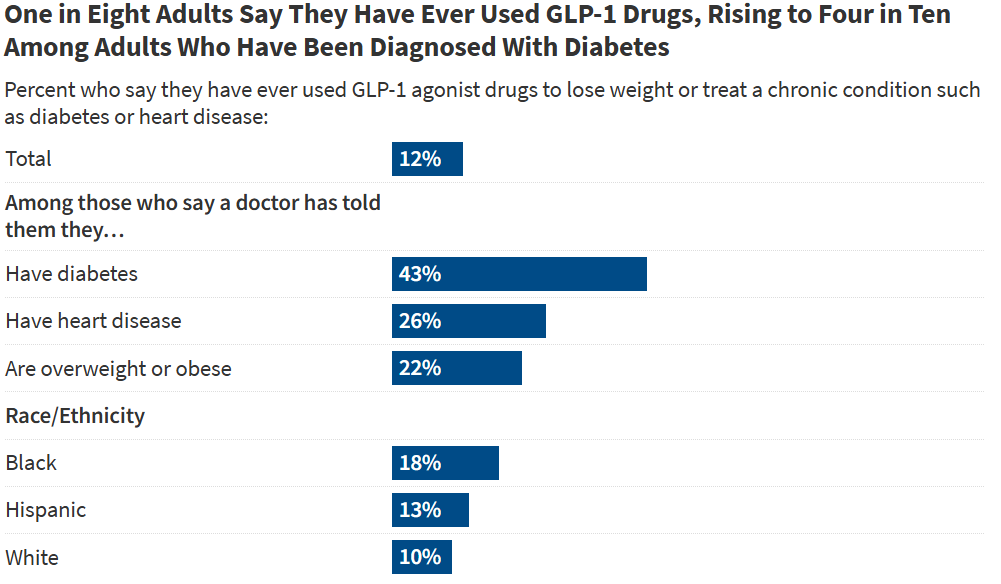

Zegler notes Mintel found that 12%+ of weight-managing adults have previously used GLP-1 drugs, roughly the same share as those currently on them 3. That suggests plenty of former patients need on-going nutritional support.

“There’s a real opening for foods and supplements that replicate that satiety benefit,” Zegler says, “particularly for people no longer on the drug but still keen to manage weight.”

Changes in Taste Perceptions and Food Desires

A less-discussed twist is how these medications may dampen taste perception itself. Emilie Fromentin points to a recent study in Physiology & Behavior showing depressed perception of all five taste qualities – sweet, sour, salty, bitter, savory – among GLP-1 users 4.

“We need more research,” says Fromentin. “But anecdotally, patients report they just don’t crave sweets or certain rich flavors as strongly, which might explain why they gravitate to fresh produce and yogurt.”

Meanwhile, muscle loss remains a key concern. Clinical data shows 15% to 60% of total weight lost on GLP-1 drugs can be lean mass 5 – which has massive potential metabolic downsides.

“Beyond its structural roles, muscle influences glycemic control and metabolism,” says Martin. “Users should focus on high-quality protein intake and resistance training to minimize lean mass loss.”

Some scientists even recommend whey over casein-based proteins, given casein’s clotting effect in the stomach might amplify fullness and reduce intake of crucial nutrients.

Unexpected Changes in Consumer Behavior

Given these complexities, the consumer journey isn’t straightforward. Severe nausea can make patients seek bland, fortified foods on “new dose days,” while intermittent usage patterns mean people may “go on and off” the drug, as Fromentin points out.

“That’s another opportunity: post-treatment solutions. Cost is a big factor, so we expect waves of usage,” she adds. “Food companies should track new drug releases and remain agile.”

Commercial Implications and Market Adaptation

How Early Movers Are Responding

Faced with these seismic shifts, big players are experimenting with different strategies. Danone took the lead in proactively spotlighting existing products suited to GLP-1 users. A dedicated page on its website showcases protein-rich yogurts and shakes.

“Danone NA highlights items that address GLP-1 challenges – muscle preservation, bone density, minimal added sugar,” says Martin. “Coca-Cola touts that two-thirds of its portfolio has low or no calories, Campbell’s pushes nutrient-rich soups, and Nestlé just launched an entire new brand – Vital Pursuits – targeting this demographic.”

Vital Pursuits focuses on portion-controlled frozen meals (250–400 calories) high in protein and fiber. The brand doesn’t mention GLP-1 meds explicitly; it simply bills itself as “High Protein, Portion Aligned, Essential Nutrients.”

On the other end of the spectrum, Conagra is testing an “ON TRACK – GLP-1 Friendly” icon for select Healthy Choice meals, calling out high-protein, high-fiber recipes right on the package. Conagra wants to help GLP-1 users spot these products immediately. It’s a bold approach – more transparent than Nestlé’s stealth branding, but also riskier.

New Foods and Supplements for GLP-1 Users

The lines between food and supplement are blurring. Many GLP-1 users need added nutrients to compensate for lower intake.

“There are parallels between GLP-1 and bariatric surgery patients – both need daily multivitamins,” notes Zegler. “GNC has created dedicated sections for these customers, offering muscle-health, hydration, and energy formulations.”

Danone, for its part, is betting on functional dairy, high-protein snacks, and specialized lines to combat muscle loss. Martin believes in packaging these solutions with education:

“Should you create a specific GLP-1 product line or simply adapt existing SKUs? Either way, bridging knowledge gaps – on muscle preservation, GI side effects, or nutrient deficits – is key.”

Meanwhile, Semper Organics (where Ward works) is exploring how mushrooms and fermentation can deliver nutrients in compact volumes. Ward sees consumer interest in functional foods:

“With new dosage levels come intense side effects, and patients crave gentle, tummy-friendly solutions – fortified crackers, ginger-infused soups, or microbe-based snacks to help with GI symptoms.”

Consumer Response to New Products

So far, the data on consumer response is limited but telling. Some early adopters want explicit labeling (“GLP-1 Friendly!”), but others prefer stealth.

“80% of GLP-1 users are looking for products marketed for their needs, but only 21% want it outright stated on the label,” Martin says, citing a recent Danone-commissioned survey. “It’s a delicate balance: you have to guide them without making them self-conscious.”

Ward sees a clear split: “Some patients want super-clean, less-processed food; others still need convenience. They just want better macros, vitamins, and easy digestion.”

Product Development & Innovation Strategies

Addressing GLP-1 Users Without Alienating Others

Food giants are currently facing a major marketing question: How to reach GLP-1 consumers while ensuring their products also remain appealing for general consumers?

“Using calls like ‘portion aligned’ or ‘excellent source of protein’ resonates with GLP-1 users without explicitly calling them out,” explains Martin. “Retailers can also create store/website sections to cluster these products – think of Walmart’s online gating strategy. But direct labeling can backfire.”

Nestlé tries a middle path with Vital Pursuits, including a QR code that leads curious consumers to a page explaining how the meals are ideal for smaller appetites. By contrast, Conagra’s ON TRACK logo is an experiment in radical transparency.

Specific Product Opportunities for GLP-1 Patients

The panelists agree that muscle preservation is top priority. That means high-quality proteins, plus fiber and probiotics for GI health. Smaller portion sizes are also a must.

“We need to pack nutrients in every bite – whether it’s a compact meal, or a snack that’s bland enough to help with nausea but still delivers protein,” says Ward.

Healthy fats, minimal sugar, plus vitamins D, B12, and iron are also on the radar. Fromentin underscores the potential of advanced flavor systems to help ensure GLP-1 patients are receiving adequate nutrition:

“Taste solutions can help keep the eating experience pleasant despite GLP-1 patients’ reduced taste perception. We’re also leveraging technologies that have been historically utilized for specialized medical nutrition – such as compacting nutrients into small volumes.”

These recommendations align with research showing that 56% of GLP-1 users say they’re opting for more nutritious foods over junk food, 66% report cutting back on soft drinks and alcohol, and 38% are increasing their protein drink intake 6.

Lessons From Previous Health Trends

Our experts see parallels with earlier diet booms, but also big differences. Low-carb, low-fat waves primarily hinged on consumer willpower. GLP-1 reconfigures biology itself.

“We might see some reversion to old preferences, like low-fat to lessen nausea and GI distress,” says Ward, “but each patient’s needs differ drastically. One-size-fits-all solutions won’t cut it.”

Zegler emphasizes:

“Consumers – on GLP-1 or not – still have personal preferences about what to add or avoid. High protein, hydration, and fruits and veggies remain universal for weight loss. The difference is, GLP-1 users feel satisfied faster.”

Long-Term Solutions Beyond the GLP-1 Moment

Looking ahead, new classes of weight-loss drugs may address muscle loss or further alter appetite. Fromentin points out that global expansion is inevitable, with cost the biggest barrier abroad:

“Companies should plan for the day these meds become more affordable or covered by insurance in Europe, Latin America, or Asia.”

Ward adds:

“You can’t just design for the GLP-1 moment,” says Ward. “What about transitioning off the meds? Or layering with new treatments that preserve muscle? Or conversely, products to support lifetime users? Products that adapt with the consumer’s journey will have staying power.”

Zegler reminds us:

“GLP-1 is another tool in the weight-management toolbox. With research pointing to many users only using GLP-1s for a short period of time, it’s smartest for companies to build products that fit the foundations of health and wellness – protein, fiber, hydration, and natural ingredients – rather than try to add labels and formulations to align with the latest craze in weight loss.”

Martin echoes this sentiment:

“Don’t limit yourself to ‘for GLP-1 users only.’ Post-treatment might be even more critical, especially if people rebound or look for gentle ways to keep weight off.”

A Call to Action for the Food Industry

Collectively, the panel drives home a stark reality: GLP-1 drugs have handed consumers a powerful tool to control hunger, and now the ball’s in the food industry’s court to meet consumers’ needs for healthier, more nutritious options. The opportunity is huge, but seizing it requires swift and strategic moves:

- Embrace Nutrient Density

Every product – from snacks to meals – should deliver more protein, fiber, and micronutrients per bite. This benefits GLP-1 and non-GLP-1 customers alike. - Right-Size Portions and Packaging

If shoppers only want a few bites, give them portion-aligned formats. Single-serve packaging or 100-calorie packs can prevent waste and encourage mindful eating. - Communicate Benefits, Not Medications

Consumers want help finding muscle-supporting, GI-friendly, or portion-aware products, but don’t necessarily want “GLP-1” emblazoned on the label. Emphasize function (high protein, nutrient-dense) rather than referencing the drug. - Invest in R&D and Partnerships

Collaborate with nutritionists, ingredient suppliers, and even fitness brands to tackle issues like muscle loss, taste modulation, and side-effect management. Leverage emerging “compacting” technologies from specialized medical nutrition fields. - Anticipate Future Drug Classes

Already, combination therapies are in trials, some addressing muscle atrophy or boosting metabolism further. Stay agile, as the “appetite puzzle” could keep evolving.

Above all, the best hedge is to create robust, healthy foods that align with consumers’ broader wellness goals.

Companies that double down on ultra-processed, empty-calorie products and ignore the GLP-1 trend risk slowly declining as consumers reallocate their dollars. In contrast, those who innovate with quality and wellness in mind can capture not only the GLP-1 segment but also the broader shift of consumers who, with or without medications, want to eat more healthfully.

The food industry stands at a crossroads. GLP-1 drugs have handed consumers a powerful tool to control their eating – and they are using it. Rather than lamenting that people are buying fewer snacks or beverages, smart brands see a chance to become partners in consumers’ health journeys. By delivering products that align with new eating habits, companies can maintain relevance and loyalty.

To the food industry professionals, it’s time to meet the moment: adapt boldly, innovate relentlessly, and help shape a healthier, more resilient food culture for all. Your consumers’ appetites may be shrinking, but their expectations are not – and meeting those expectations is the path to thriving in this new world.

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2024/glp-1-meds-impact-on-food-and-bev-ind.pdf ↩︎

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5073929 ↩︎

- https://www.kff.org/health-costs/poll-finding/kff-health-tracking-poll-may-2024-the-publics-use-and-views-of-glp-1-drugs ↩︎

- https://www.sciencedirect.com/science/article/abs/pii/S003193842400341X ↩︎

- https://dom-pubs.onlinelibrary.wiley.com/doi/10.1111/dom.15728 ↩︎

- https://www.foodbusinessnews.net/articles/27466-boom-in-glp-1-drugs-augurs-food-industry-disruption ↩︎

Leave a Reply